Beyond Bitcoin: AI, Stablecoins, and the Future of Money

Part 2, Stablecoin Infrastructure

But First – A Guide for Non-Technical Readers

Before we get into this series of articles on fintech, here are some basics on cryptocurrency to help define the terminology.

A stablecoin is digital money that works like sending an email instead of mailing a letter. It moves instantly, costs almost nothing, and works anywhere in the world. Bitcoin is the name for just one of many other digital currencies. But it is the most well-known because it was the first on the market and is still considered the most reliable due to its longevity. A fundamental difference between stablecoins and Bitcoin is that stablecoins are backed by actual assets (mostly one US dollar each), while Bitcoin and its counterparts are not backed by any underlying assets. Hence, they are not “stable.”

Think of stablecoins as digital cash that you can send globally as easily as sending a text message. It is a way of moving money that uses computers talking directly to each other over the internet, instead of banks sending messages to each other. That makes the movement of stablecoin money faster, more efficient, more auditable (reduced potential fraud), more secure, and less expensive. With that understanding, the US dollar (USD) dominance reflects network effects and first-mover advantage, not necessarily optimal global design. As regulatory frameworks mature, expect a multi-currency ecosystem. Geopolitics do matter. Currency stablecoins are not just technical/financial, they’re geopolitical. EU wants euro stablecoins, China develops digital yuan, countries compete for digital currency dominance. Each particular use case determines currency driving the optimal stablecoin currency depending on the specific use case (e.g., corridor, invoice currency, user preference, regulatory jurisdiction). The future is definitely multi-currency. While USD stablecoins dominate today, a multi-currency stablecoin ecosystem is emerging and will likely become standard.

Much like understanding that electricity comes through the grid, or that water is treated at plants, understanding that money can now move digitally across borders is fundamental. Understanding stablecoin is understanding modern infrastructure literacy.

Bitcoin is exciting but volatile—worth $60,000 one day, $45,000 the next. You can’t use that to pay rent.

A stablecoin is different:

Backed by actual assets (many times US Dollars) in a bank account (like old-fashioned money)

The “coin” part just means it’s digital and moves on internet technology

The “stable” part means its value is always tied to actual assets

Stablecoin is a crypto-currency in that it uses the same technology as cryptocurrency, but it’s different in practice

Stablecoins are just the next evolution, making international transfers as easy as Venmo/Zelle/ApplePay, but for any country.

Bitcoin is like investing in the stock market. Its value changes constantly depending on how many people want to own it and how much they are willing to pay for it. A stablecoin is like having cash in your wallet. Its value stays the same. Both cryptocurrencies like Bitcoin and stablecoins can now fly across the world in seconds but Bitcoin (and similar cryptocurrencies) are often preferred in unstable governments where the avoidance of chain of ownership may be a critical consideration.

In summary, even though USD-pegged stablecoins dominate current market share and media attention, the stablecoin concept is fundamentally currency-agnostic. The same technical and business principles that make USDC valuable for dollar-based transactions apply equally to EUROC for euro transactions, GBPT for pound transactions, or any other currency stablecoin.

As regulatory frameworks mature globally, expect the stablecoin landscape to become increasingly multi-currency. The key insight is that stablecoins are an infrastructure architected for moving value, and value exists in many currencies. Just as the internet doesn’t prefer English over French (it’s protocol-agnostic), stablecoin technology doesn’t inherently prefer dollars over euros or pounds. Market dynamics, regulatory frameworks, and network effects determine currency dominance, but these can shift.

If you would like to learn more about stablecoin currencies, this article lists the six largest ones and provides descriptions for each.

To understand the current paradigm shift we are experiencing we need to understand what is changing.

The Old Narrative (Pre-2024): The conversation around cryptocurrencies in traditional finance followed a predictable pattern: banks viewed crypto as risky, volatile, and primarily the domain of speculators and tech enthusiasts. Bitcoin’s price volatility, regulatory uncertainty, and association with illicit activities created a clear boundary between “crypto” and “real banking.” Stablecoins existed but operated largely in the shadows of traditional finance, used primarily by crypto traders to move between exchanges or by Decentralized Finance (DeFi) protocols. Banks watched from the sidelines, cautious about reputational risk and unclear regulatory guidance.

The Evolving Reality is that the fundamentals have shifted. Stablecoins and cross-border digital payments are no longer relegated to a side track or experiment. They occupy center stage in boardroom discussions, with major financial institutions openly discussing USD-pegged tokens, on-chain Foreign eXchange rails, and proactive regulatory engagement. What used to be niche (token-based FX, digital cross-border payments), is now mainstream boardroom discussion. With major players discussing USD-pegged tokens, on-chain FX rails and procedural regulatory engagement, this segment is moving past hype and entering execution. The transition can be summarized as, “Should financial institutions explore this?” to “How do financial institutions operationalize this at scale?”

This matters because of three things. The first is the economic imperative driven by the cross-border payments challenges. For companies operating in high-volume corridors (US-Mexico, US-India, intra-Latin America), the cost savings will compound quickly. A mid-size importer processing $10M annually in cross-border payments could save $600,000+ in fees while improving treasury forecasting through faster, predictable settlement.

Looking at the numbers, traditional cross-border payments remain expensive, slow, and opaque:

Average cost: 6.25% of transaction value (World Bank data)

Settlement time: 3-5 business days for standard transfers

Hidden costs: FX spreads, correspondent banking fees, intermediary charges

Opacity: Recipients often don’t know the final amount or timing

For a business sending $100,000 from the U.S. to Mexico for supplier payments, the math is stark:

Traditional wire: $6,250 in fees, 3-4 day settlement, unknown final Mexican (MXN) amount

Stablecoin rail: $50-200 in fees, settlement in minutes, transparent conversion rate

The second is that financial institutions are getting the regulatory green light. The critical shift currently underway is regulatory re-positioning. Rather than prohibiting or heavily restricting digital assets, regulators are signaling a pathway forward, provided banks maintain control and compliance. Regulators are handing banks the keys to digital assets on the banks’ terms. The message is now financial institutions can do this, just under the institution’s roof and in a compliant, explainable way. That matters because it reframes the roadmap: compliance-grade on-chain, audited rails, trusted infrastructure. The fundamental reframing transforms from the old model characterized by banks vs. crypto (adversarial, zero-sum) to a new model characterized by banks as crypto infrastructure (collaborative, additive). For example, Western Union has announced plans to launch the U.S. Dollar Payment Token (USDPT) stablecoin in 2026. This isn’t a crypto startup disrupting Western Union. It’s Western Union embracing tokenized infrastructure while leveraging its 170-year brand, compliance systems, and global network.

The third is technology’s significant maturation. Blockchain networks now offer:

Transaction throughput: 10,000+ Transactions per Second (TPS) on modern Layer 2 (L2) Open System Interconnection (OSI) networks

Settlement finality: Sub-second to minutes depending on chain

Cost predictability: Total blockchain transaction fees stabilized through scaling solutions (aka gas fees)

Enterprise tooling: Application Programming Interfaces (APIs), Software Development Kits (SDKs), and monitoring dashboards

Regulatory reporting: On-chain audit trails and compliance modules

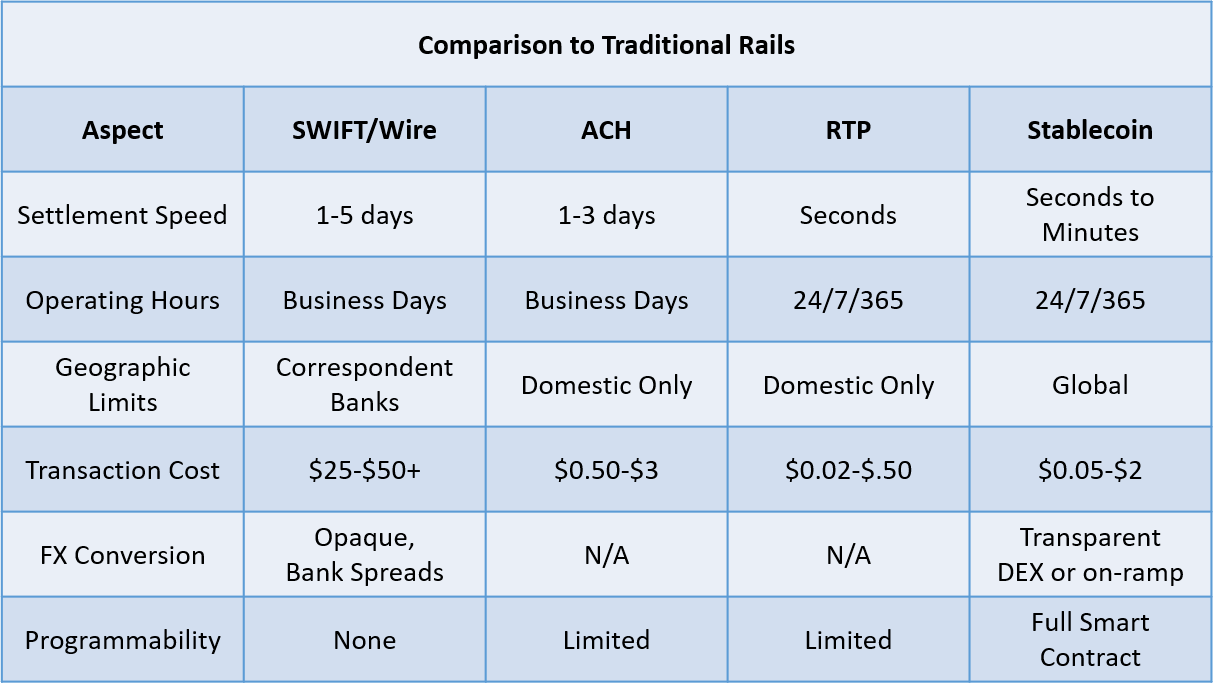

As importantly, the integration points between traditional banking systems and blockchain rails have been standardized. Banks don’t need to rebuild their entire stack. They can add stablecoin capabilities as a new rail alongside international money transfers by US Automatic Clearing House (ACH), Society for Worldwide Interbank Financial Telecommunications (SWIFT), and Real Time Payments (RTP).

So how do Stablecoin Rails actually work? The stablecoin stack is comprised of four layers.

Stablecoin Stack Layer 1, the Token Layer defines the stablecoin. A stablecoin is a blockchain-based token designed to maintain a stable value relative to a reference asset (typically USD, EUR, or other fiat currencies). Its key technical characteristics include:

Token Standards: Ethereum (ERC-20), Solana (SPL), or proprietary

Risk Reducing Backing Mechanisms: Fiat reserves, overcollateralized crypto, algorithmic

Issuance: Mint when dollars deposited, burn when redeemed

Transferability: Peer-to-peer without intermediaries

Programmability: Smart contract compatible for automated logic

Popular stablecoins in financial services include:

USDC: (United States Dollar Coin) a stablecoin (managed by Circle fintech company) entirely backed by U.S. dollars and dollar-denominated assets, offering a price-stable digital currency alternative amid the high volatility of other cryptocurrencies like Bitcoin and Ethereum.

USDP: (United States Dollar Peg) a New York Digital Financial Services (DFS) regulated, institutional focus pegged to the US Dollar issued by Paxos Trust Company.

Bank-issued tokens like J.P. Morgan Coin (JPMD), US Dollar Payment Token (USDPT) (Western Union coming 2026). A critical business distinction is that bank-issued stablecoins offer something independent crypto stablecoins cannot: direct integration with banking licenses, FDIC insurance considerations, and trusted brand relationships with corporate treasurers.

Stablecoin Stack Layer 2, the Settlement Layer is where the transaction happens. When a stablecoin payment is sent, several things occur nearly instantaneously:

Transaction Initiation: Sender’s wallet signs a transaction transferring tokens to recipient’s wallet address

Network Propagation: Transaction broadcast to blockchain network nodes

Validation: Nodes verify signature, sufficient balance, compliance with token rules

Block Inclusion: Transaction included in next block by validators/miners

Finality: After sufficient confirmations (seconds to minutes), transfer is irreversible

Stablecoin Stack Layer 3, the Liquidity Layer is where the conversion of assets occurs. Stablecoins solve the movement problem, but businesses still need local currency. The liquidity layer handles conversion:

On-Ramps and Off-Ramps:

On-ramp: Convert fiat → stablecoin (via bank, exchange, or payment processor)

Off-ramp: Convert stablecoin → local fiat (reverse process)

Evolving modern architecture results in banks building “Treasury As A Service” which capabilities include:

Corporate client maintains dollar account at Bank A (US)

Initiate payment through banking portal

Bank A’s treasury converts USD → USDC internally

USDC transferred on-chain to Bank B (Mexico)

Bank B’s treasury converts USDC → MXN

Recipient receives MXN in local bank account

The business implication is that the end-user experience remains familiar (dollars in, pesos out) but the underlying rail has transformed, capturing cost and speed benefits while maintaining regulatory compliance through bank intermediation.

Stablecoin Stack Layer 4, the Compliance Layer governs the processes associated with meeting regulatory requirements. This layer is what makes stablecoins viable for regulated financial institutions. Key compliance components include:

Know Your Customer (KYC) and anti-money laundering (AML) at endpoints: Banks verify identities during on/off-ramp

Transaction monitoring: Real-time screening against sanctions lists

Audit trails: Immutable on-chain records for regulatory review

Reserve attestations: Monthly proof of 1:1 backing for stablecoins

Jurisdictional controls: Geographic restrictions programmed into smart contracts

The adoption path for financial institutions is less about ‘if we’ll do it’ and more about ‘how we’ll do it’. We can expect them to quietly become the anchor for digital-asset rails, rather than being left out of the conversation.

The most compelling narrative is that global payments are not converging toward a single solution. They’re fragmenting intelligently, based on corridor-specific dynamics. This requires financial institutions to adopt business model transformations that focus upon corridor economics.

The common assumption is that global payments are converging. But it is clear that varying levels of open-banking maturity, regulatory heterogeneity, corridor-specific business models mean we’re not heading toward one-size-fits-all global rails. Instead, the emerging model is programmable rails + tailored stacks.

Let’s examine the US-Mexico Corridor example with the following current solution architecture for both remittance and business use cases:

Volume & Importance:

$63 billion in remittances annually (2024)

18+ million transactions per year

Critical for Mexican household income (4% of GDP)

Traditional Pain Points:

Remittance fees: 5-7% average

Currency volatility risk during 3-5-day settlement

Limited transparency for senders

Physical cash pickup requirements for many recipients

Future Stablecoin Solution Architecture:

For Remittance Use Case:

Migrant worker in US deposits cash at retail location (Walmart, CVS, etc.)

Retail agent converts USD → USDC instantly

USDC transferred on-chain to Mexican fintech partner

Mexican fintech converts USDC → MXN at transparent rate

Recipient receives MXN via mobile money, bank transfer, or cash pickup

Total time: 5-30 minutes

Total cost: 1-2% (compared to 5-7%)

For Business Payments:

US importer needs to pay Mexican supplier $500,000

US bank converts from company’s dollar account → USDC

USDC sent on-chain to Mexican bank

Mexican bank credits supplier’s peso account

Total time: 15 minutes vs. 3-4 days

Cost: $200 vs. $12,500

FX rate: Market rate + 20 basis points (bps) vs. market rate + 300bps spread

Revenue Model Shift for Financial Institutions

Current model:

Revenue: FX spread (2-4%) + wire fees ($25-50) + intermediary fees

Volume-dependent, hidden pricing, customer friction

Stablecoin model:

Revenue: Smaller per-transaction fees (0.5-1%) + treasury services + API access fees

Volume scaling, transparent pricing, better customer experience

New revenue: Liquidity provision, stablecoin issuance, infrastructure-as-a-service

The strategic consideration becomes adopting the stablecoin model. Financial institutions will be trading with a higher-margin, high-volume business with better customer retention and platform stickiness.

Strategic Implications for Financial Institutions

Financial institutions now have a re-architecture imperative. They are now facing the requirement to re-architect the stack for AI-native operations. It’s not enough to wrap AI around legacy workflows. If the financial institution is still reacting to ‘we have AI pilots,’ they are already behind. The new question: how do you embed agents, data-services, decision-services, auditing and continuous feedback loops into your core operating model?

This applies equally to stablecoin infrastructure. Financial institutions face a choice:

Option A: Bolt-On Approach (Suboptimal)

Add stablecoin capability as separate product

Maintain parallel systems for traditional and digital rails

Manual reconciliation between systems

Limited automation, higher operational risk

Option B: Native Integration (Optimal)

Rebuild treasury operations to be “rail-agnostic”

Unify liquidity management across fiat and digital assets

API-first architecture enabling partner ecosystem

Automated routing: system chooses optimal rail based on cost, speed, compliance

Historically, these options mirror how financial institutions, including banks, adopted real-time payments (RTP). Early adopters who integrated RTP deeply into core financial systems gained market share. Late adopters who treated RTP as a “nice-to-have” feature found themselves at a competitive disadvantage.

Every financial institution’s future is composable, not monolithic. Whether for AI, data platforms, payments rails or identity fabrics, the stack they choose to build should allow plug-in services, partner ecosystems and rapid iteration.

For stablecoins, this means financial institutions need to prioritize implementing the following building blocks:

Token issuance: Mint/burn own stablecoins OR custody third-party stablecoins

Wallet infrastructure: Secure key management, multi-signature, institutional custody

Liquidity management: Automated treasury operations, yield optimization

Compliance engine: Transaction monitoring, sanctions screening, reporting

Partner network: Fintechs, exchanges, on/off-ramp providers

Developer platform: APIs for corporate clients to embed stablecoin payments

Financial institutions winning in this space aren’t building everything in-house. They’re orchestrating ecosystems where they provide the regulated core infrastructure and partners provide specialized services.

Fundamentally, stablecoins represent the convergence of three powerful forces: economic imperative (cheaper, faster payments), regulatory enablement (compliance-friendly pathways), and technical maturity (production-ready infrastructure).

This is no longer experimental. It’s operational. Banks are moving from “should we?” to “how do we?” The institutions that architect their systems for composability, embrace corridor-specific strategies, and build true digital-native capabilities (not bolt-on solutions), will capture market share in the $150+ trillion global payments market.

The current generation of technologists and financiers will build this infrastructure. Understanding both the technical mechanics and business implications positions rising star technologists to lead this transformation.

If our AI research sparked something valuable for you, consider leaving a tip to help us keep processing the future, with our thanks in return!